While customs duties of 25 % are taken from some Canadian products and other Surchastens could add the United States, Canadian companies are looking for additional places to get and sell their products.

However, companies that are connected by narrowly woven supply channels over decades of trade agreements and sectoral specializations could quickly appear against obstacles, including traffic and labor costs, resources availability, production capacity and market saturation.

“For many companies, you can’t just press the button” to change the supplier chain, noted Ulrich Paschen, who is professor of Melville School of Business at Polytechnic University in Kwantlen, British Columbia.

The offer is a challenge

“The number of companies capable of producing these components is limited and it would not be easy to replace them,” he said of the works of cars.

The automotive sector illustrates the difficulties that many companies face. Canada exports approximately 1.5 million vehicles completely assembled in the United States every year, which, according to the Canadian Chamber of Commerce, represents 8 to 10 % of American car consumption. It is an important market to conquer overnight.

In addition, many parts will exceed the limit several times before the final assembly, which means that US customs obligations of 25 %, as well as any mutual customs law, would increase production costs and eventually show the price.

See too The inhabitants are afraid that Trump’s customs tariffs are only “first step”

Also, American car manufacturers do not tend to turn their backs to Canadian partners. According to the Canadian Chamber of Commerce, the cancellation of contracts with Canadian suppliers would result in the Canadian Chamber.

Canadian automotive suppliers, who are planning to move to the United States, would also be confronted with the main obstacles: closing the costs of several tens of millions of dollars per factory, labor costs for at least 20 % higher, and a period of several years before their US factory.

“Canada and the United States have an integrated commercial relationship. It has been built over the decades,” recalled vice -chairman, strategic policy and supplier chains in the Canadian Chamber of Commerce Pascal Chan.

“It’s not something easy to return,” he said.

Car, lumber and steel producers are confronted with some of the most difficult challenges in their search for new markets, said Professor Paschen.

Other challenges

The actors of the forest sector face a completely different dilemma. The export of timber, although matters, has a low value to volume compared to other raw materials.

“The transport of Canadian goods directly to the United States is quite logical. It is much less logical to send them to the other side of the world, because transport costs are becoming a decisive factor,” Mr. Paschen explained.

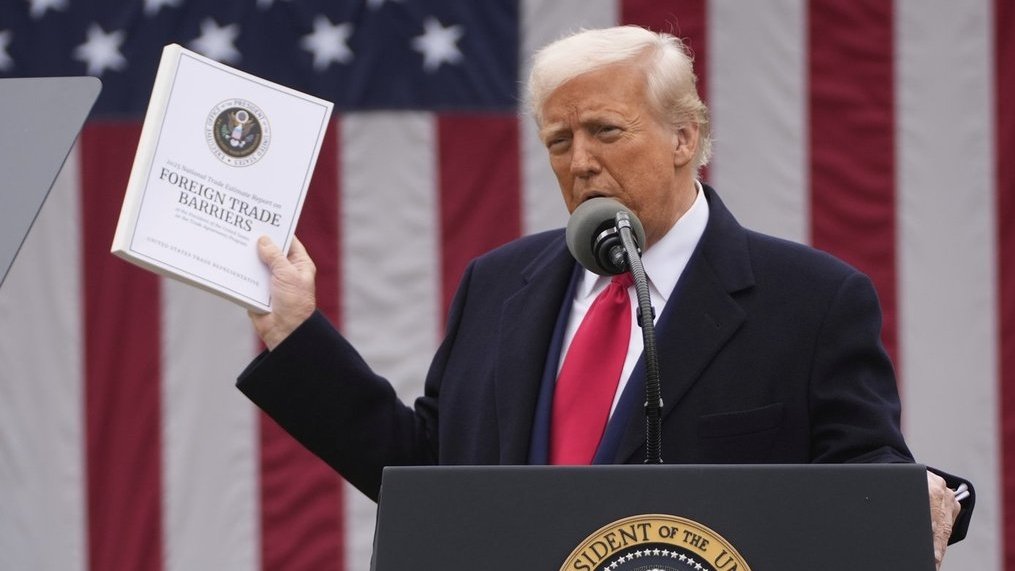

As for steel and aluminum, US President Donald Trump imposed 25 % customs duties on imports from all countries. Canada retired, as well as after taxation of other customs duties, which announced duties totaling $ 60 billion.

Canada is by far the main source of aluminum in the United States, with exports in 2024 in 2024 in 2024 the export worth $ 11.4 billion.

See too “Obviously ambiguous” Award of Donald Trump

Canada is also the main source of international steel and iron and iron of $ 13 billion, although China and Mexico are not behind.

According to experts, a significant amount of these raw materials would make their exports to other markets.

In addition, the desire to nationalize production above the basic level and to produce finished products-the statement for Canadian companies, because the Confederation-by should require time, investment and possibly government support.

“Although steel can be produced in Canada, it must be transported to the United States to convert into a structural element and then use the manufacturer for BDO Canada, Jesus Ballesteros.

“The raw aluminum is sent to the United States. It transforms into leaves or even completed cans, then these cans in Canada are re -expressed to be used to distribute beer or other drinks,” he continued.

“Here we are imprisoned in customs duties. (…) Can the Canadian industry navigate in this direction?” He asked.

Ship elsewhere?

The limited flexibility of the supply chain exceeds the production chains.

The geographical immenseness of Canada and its low population compared to the United States is an obstacle to companies trying to strengthen their domestic market, while most countries other than the United States seem to be inaccessible to many societies.

“If we do not supply to the United States, we are some island. The goods must travel long trips from Canada to address customers outside North America,” said Mr. Pasten.

Companies will hesitate to make fundamental changes in their supply chains, unless they think that the duties of high habits are there forever, he added.

Some experts called for over orientation over the whole lines of the economy, such as accelerating the transition to electric vehicles, removal of interdisciplinary commercial barriers, and acquiring direct investments and increased government participation.

“Subsidies are unlikely to be enough,” said Stuart Trew, project director and investment in the Canadian Center for Alternative Policy. Sometimes there is further coordination such as the role of the state, which makes it possible to decide what types of steel and, for example, for what purposes they are necessary. ”

The fact that many economists predicted that generalized customs duties would cause Canada in the recession, illustrate the difficulty of changing the supplier and diversification of the market in the blink of the eye.

“There are cases where the market could easily dry out,” Trew said.