Bear Trap or True Krach? What hides the fall of bitcoin to $ 113,000

Bitcoin recently plunged below $ 113,000, causing a shock wave on the markets. This decline by more than 8 %, because its summit of $ 124,000 caused a wave of pessimism among private investors. But behind this apparent panic, some analysts see the opposite signal that could announce the conversion.

In short

- Bitcoin dropped to $ 113,000, which launched a panic among private investments despite solid bases.

- Institutional people, such as strategy, massively buy bitcoins, indicating the opposite strategy in the face of a very bear feeling of retail.

- Technical indicators and emotional context cause a possible trap for Bitcoin bear and announce a bounce rather than a sustainable lower market.

Brutal Bitcoin correction … but not unprecedented

After falling below $ 115,000, Bitcoin dropped 19 August 2025,112,000, which meant one of the strongest repairs for several months. Social networks responded by virulets: crypt forums full of alarming news and small carriers began to destroy their positions in climate of generalized fear.

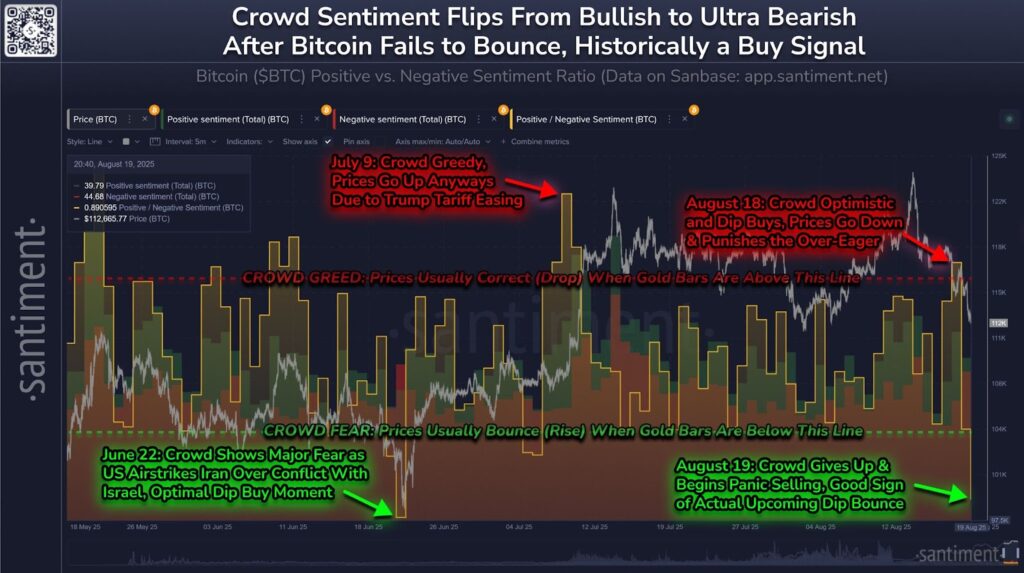

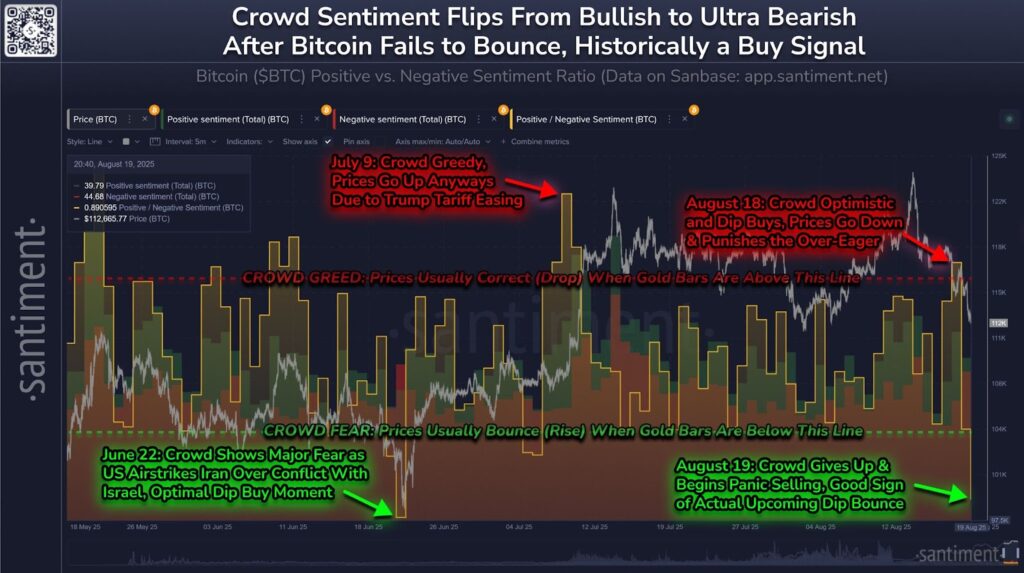

According to health data, the feeling of private investors has become ‘ Ultra -bear “Reaching its negative level since June. This type of extreme pessimism is often interpreted as a potential indicator of conversion, especially when the foundations remain solid.

Bitcoin: When institutionalists buy while retail panic

While specific traders react emotionally, institutionalists accept strategic posture. Actors, such as a strategy, took advantage of the decline to strengthen their position by purchasing another 430 BTC for $ 51.4 million. Betting on medium -term recovery.

This contrast illustrates well -known dynamics: when the retail sells in fear, the whales buy in silence. Historical precedents strengthen this hypothesis. In 2017, a decline in Bitcoins was preceded by 36 % in September three months later a new summit. In 2021, a similar drop of Haussier Rally followed.

BTC technical analysis: between tension and hope of reflection

Several technical indicators indicate the unstable situation of bitcoins, but not desperate. Really:

- RSI on 41 remains in the neutral zone and leaves the space before occurrence;

- Negative MACD denotes the momentum of low load, but without brutal collapse;

- 50 -day mobile diameter for $ 115,870 acts as a resistance;

- The head pattern in the training could cause BTC to break around $ 108,000, or even $ 105,150 if support for $ 112,000 retreats.

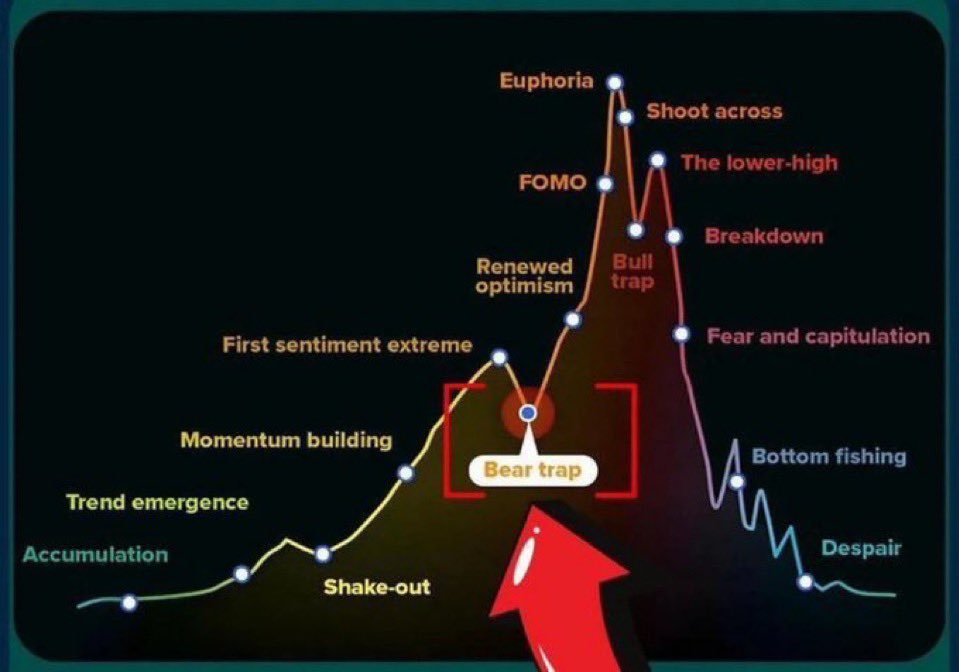

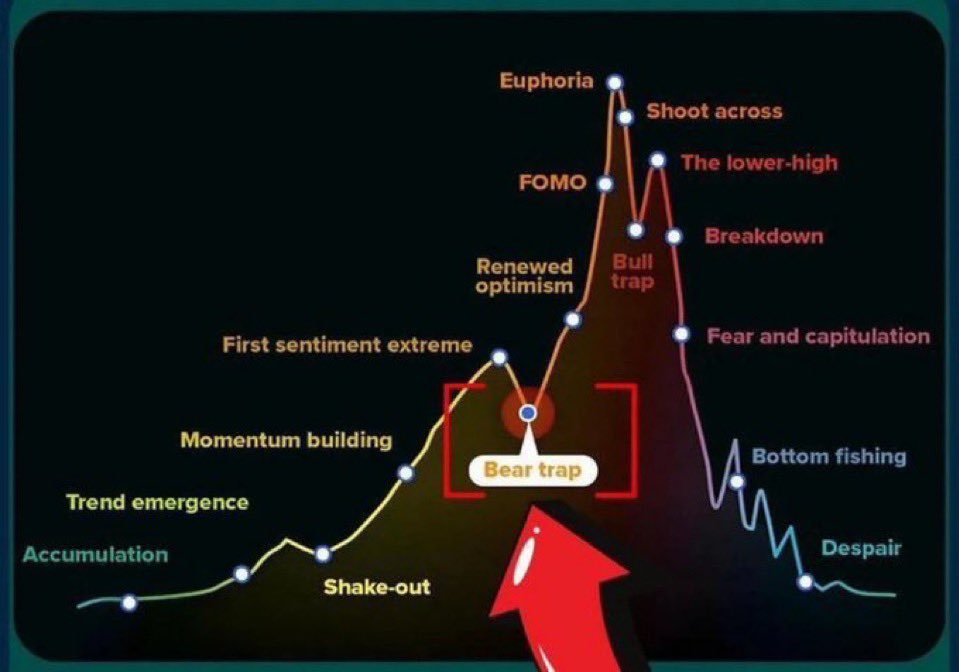

Bear Trap Bitcoin: What if it was to fall a trap?

This configuration could match ‘ Bear trap Bitcoin, a lower trap where the market simulates a negative trend that supports sales … just before reflection.

As Ryan Lee said, the main analyst of Bitget, this autumn could be a fake lower signal:

If the $ 112,000 threshold was valid as support, it could be the starting point for a new upward leg rather than resetting the market.

This hypothesis is held by retail pessimism, institutional accumulation and technical support. Bitcoin investors should therefore not give up panic. They must observe weak signals and in the long term to think.

The fall of Bitcoin to $ 113,000 is therefore not necessarily the beginning of the lower market. It can be strategic breathing and announcing a new bull cycle for those who know how to read between lines. However, the shade of Ghost Month and BTC could dive into $ 100,000.

Maximize your Cointribne experience with our “Read to Earn” program! For each article you read, get points and approach exclusive rewards. Sign up now and start to accumulate benefits.

The world is evolving and adaptation is the best weapon that survives in this undulating universe. I am interested in everything about blockchain and its derivatives. To share my experience and promote an area that fascinates me, nothing better than writing informative and relaxed articles simultaneously.

Renunciation

The words and opinions expressed in this article are involved only by their author and should not be considered investment counseling. Do your own research before any investment decision.