Ascending trend endangered by risky assets such as bitcoins? – macro point

When the latest American inflation figures were revealed, a local top on Bitcoin was found. In fact, they are much higher than expected, and therefore J. Powell and his colleagues could remain careful about rates. From August 14, the price of bitcoins has been repaired by approximately 10 %, and if the application does not leave, the king of the cryptocurrency could continue to decline at $ 100,000.

Are risk assets like bitcoins in danger? Will investors turn to hiding and gold? At the Macro point we analyze the market and look at whether negative signals interfere from technical. Let’s!

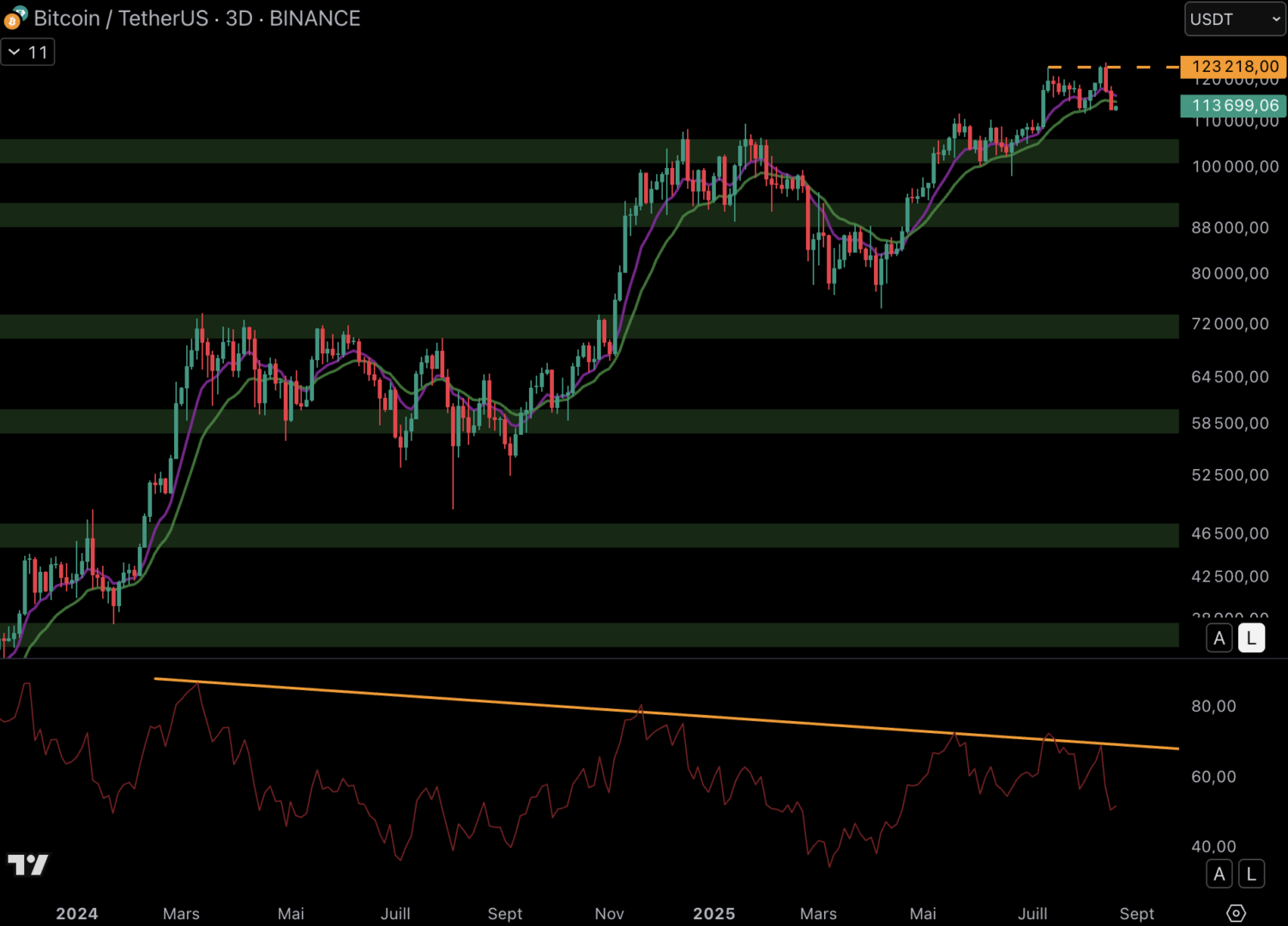

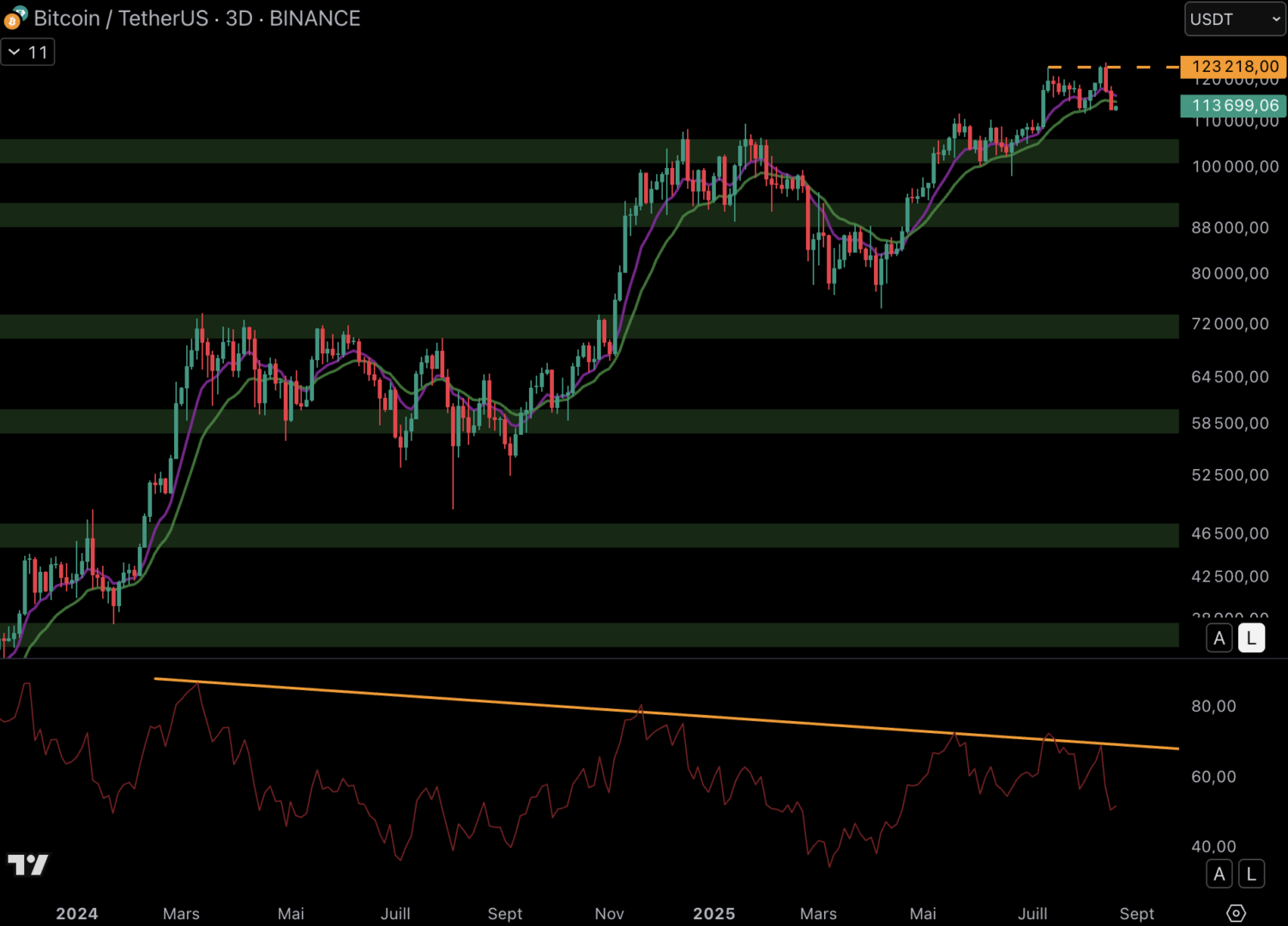

Towards the reflection on the course of bitcoins?

The king of cryptocurrency succeeded last week Closure over $ 1238 in a unit of time 3 days. This fence allows bitcoin to maintain and Ascending dynamics. WITH Fall around 10 %The course is found around Mobile Averages (EMA 9/EMA 18) Housing. And the buyers could respond here, as was the case in early August:

The buyer’s goal is Prevent ascending mobile averages and send a king of cryptocurrencies for the last Historic summit. Otherwise sellers could regain their hands and the course could drop to the next There is support for $ 104,000. Finally, even if the course has fallen, Dynamic remains encouraging For now in this unity of time.

RSI was again rejected at the level of the trend line on the spot for several months. So Momentum is obviously bullIt will take a clear transition of this trend line.

Risk of Off: The dollar is stabilized and gold decreases in volatility

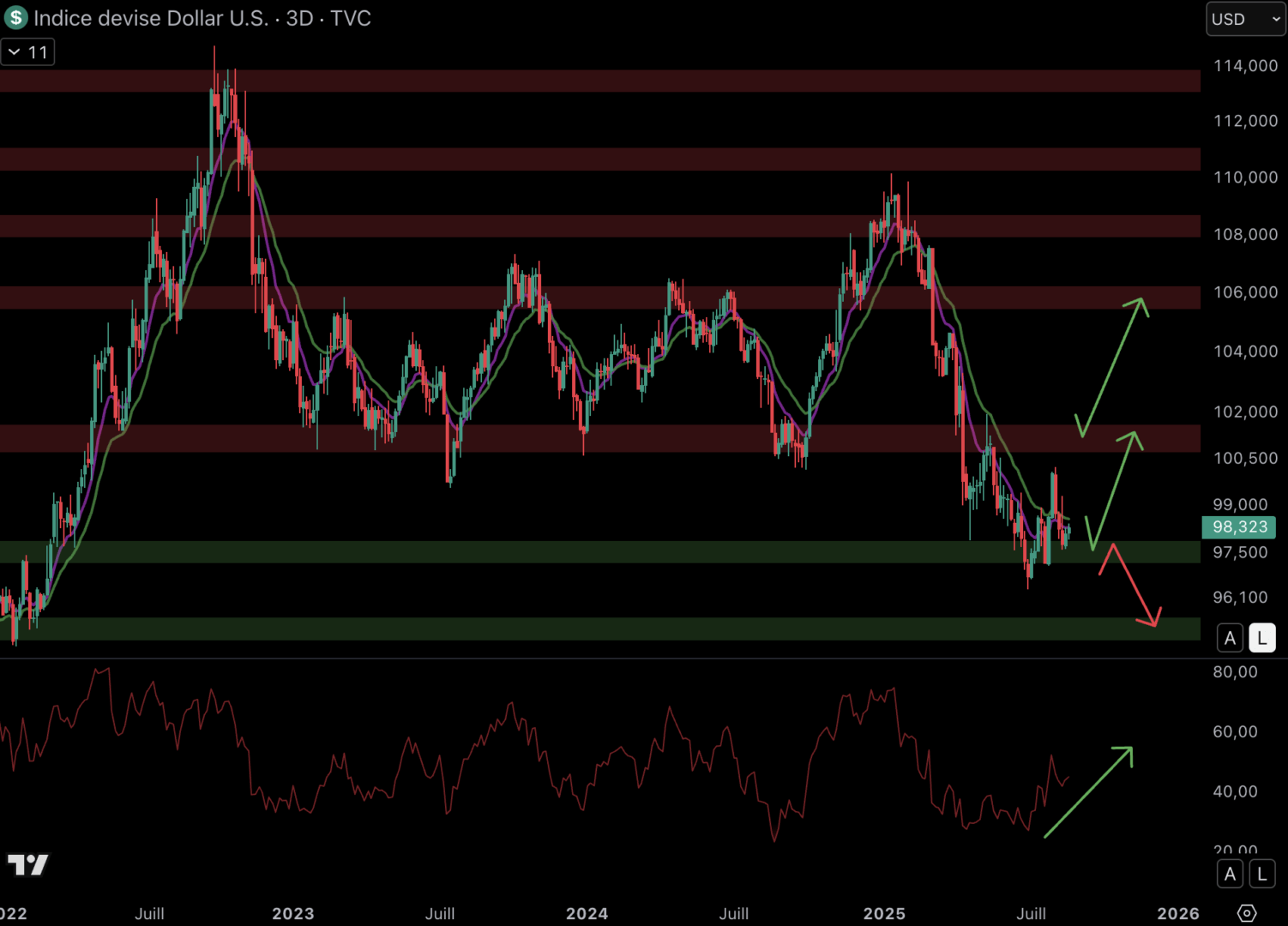

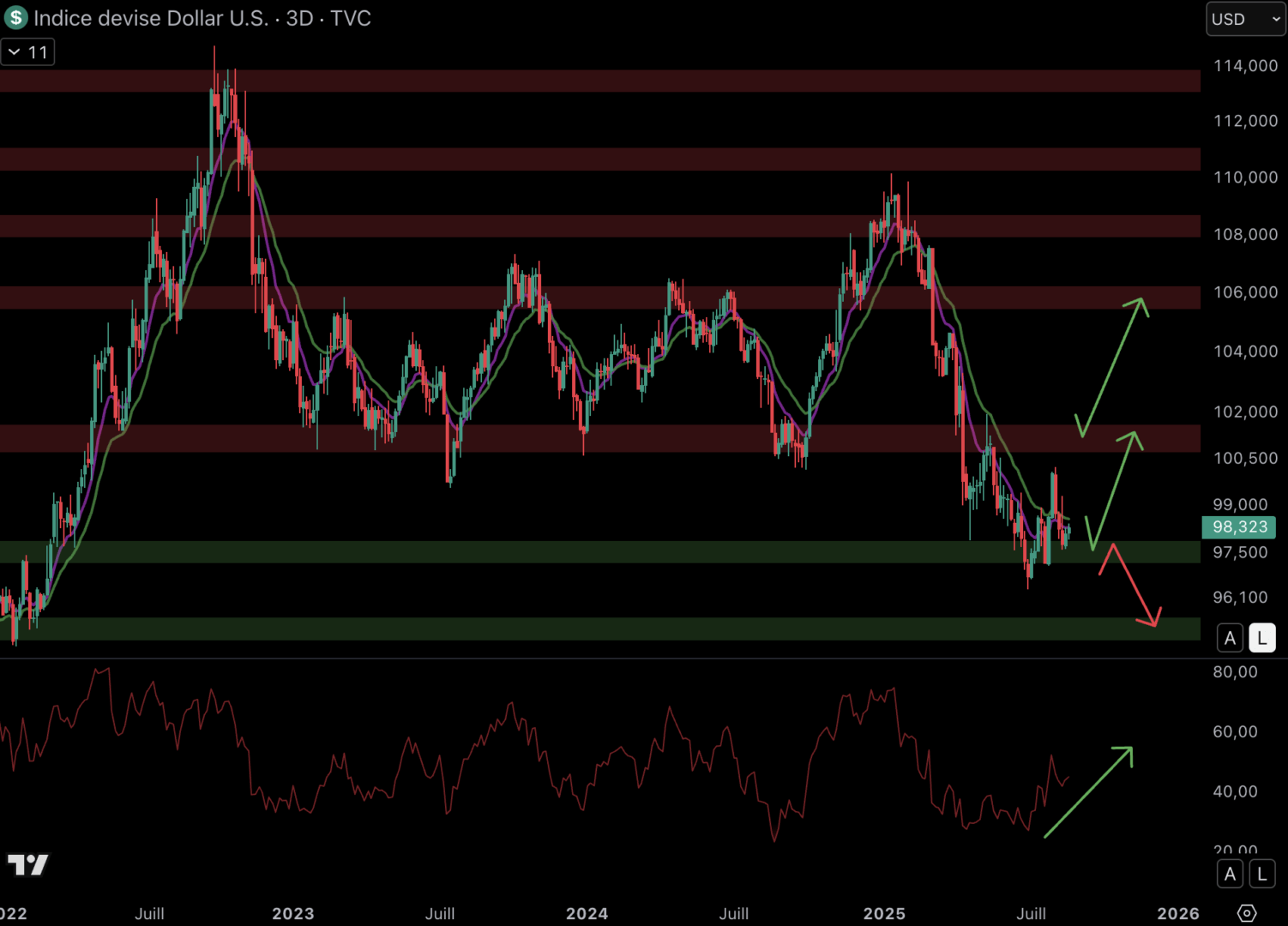

The dollar keeps support at 97.5

From implementation Customs tariffs Author: D. Trump, The dollar fell. In fact, the course of the dollar index (DXY) fell 12.5 % from the top found at the beginning of the year. But for several weeks the course managed to stay above the level at 97.5 ::

PUSH Dynamics is always down to DXY, but if 97.5 are preservedrecovery Resistance at 101 is possible. However, the course remains stuck Below the diameter of the mobile diameters (EMA 9/ EMA 18)AA Loss of 97.5 could trigger a new fall on Support to 95.

On the other side of the momentum indicator Rsi rebounds. The Momentum is therefore in favor of buyers For the time being.

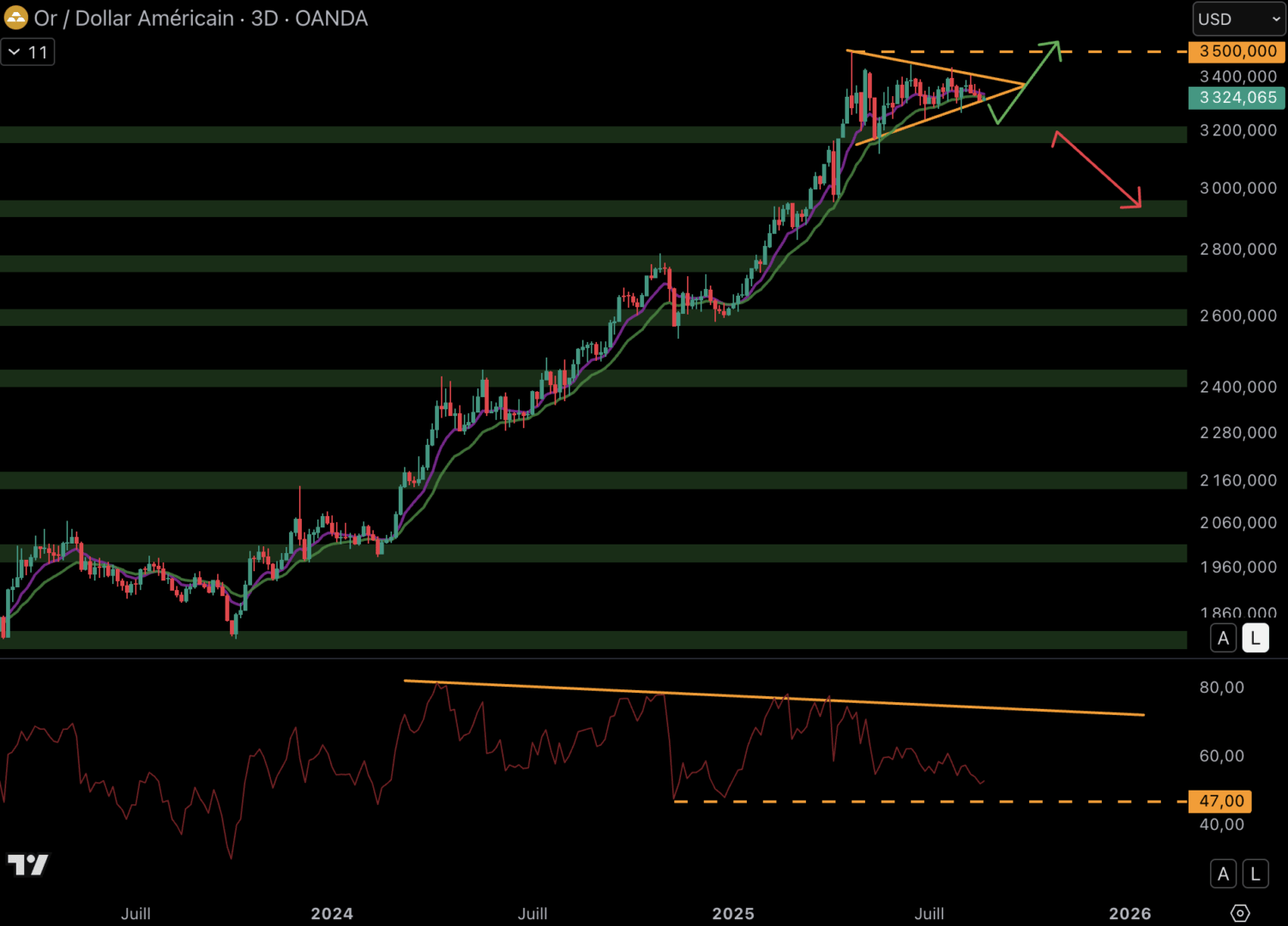

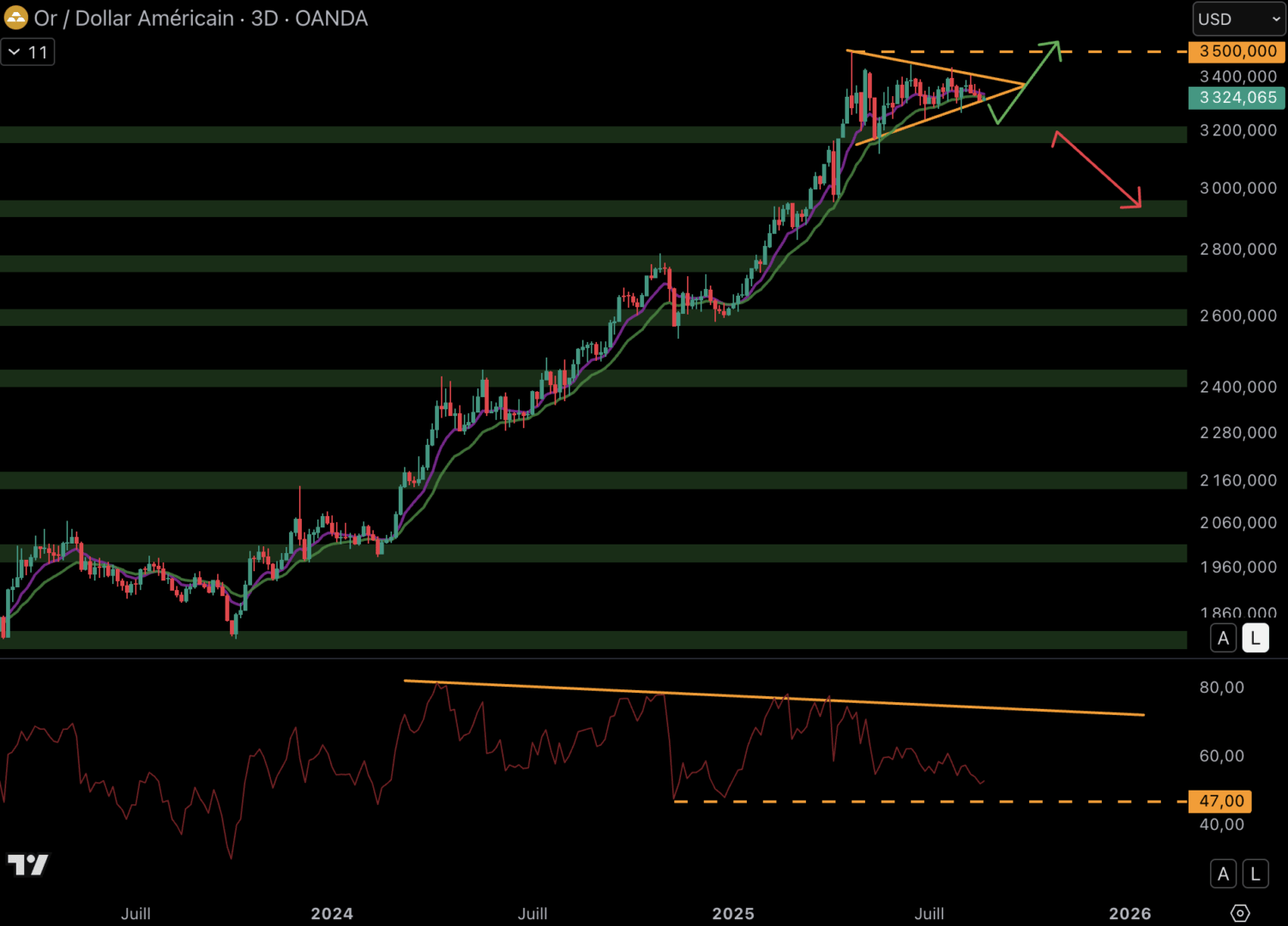

Towards up to accelerate gold?

The course of gold is installed va Ascending dynamicsBecause cavities and summits have been ascending for several years. Because the course touched 3,500 $and consolidation is in place. In addition Mobile Averages (EMA 9/EMA 18) Housing Continue to support the course and gold forms and Symmetrical triangle ::

This is figureAnd therefore the turning point in the trend line down could be generated Bull’s volatility over $ 3,500. If Support for $ 3,200 holding, and Ath It is possible for active reference refuge. On the other hand, if sellers regain their hands and course A reduction below $ 3,200could find Support for $ 2,950. The course has been developing for several years, but RSI does not follow. We have divergence on RSI and new could appear in the case of Falls within 47 years.

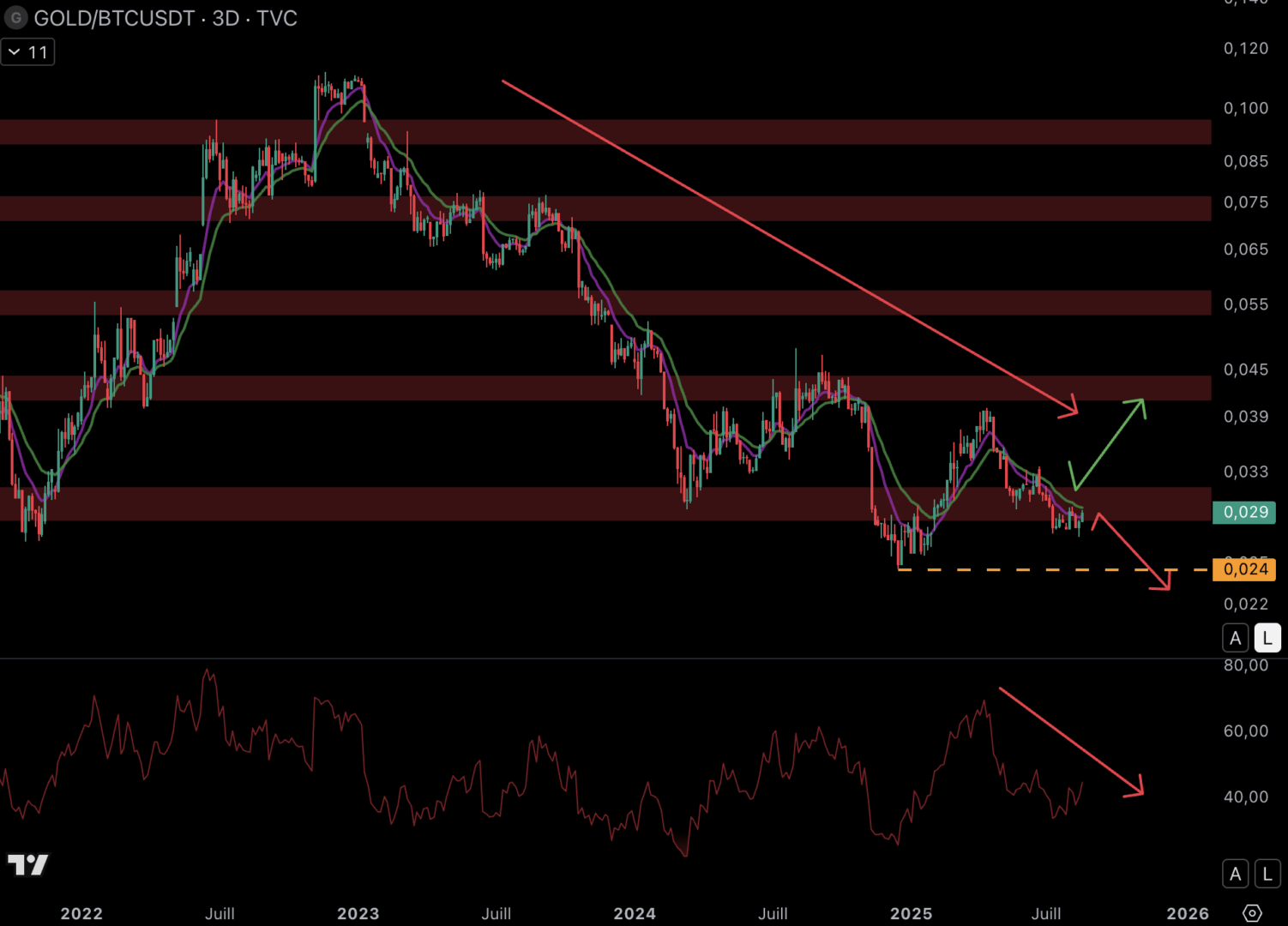

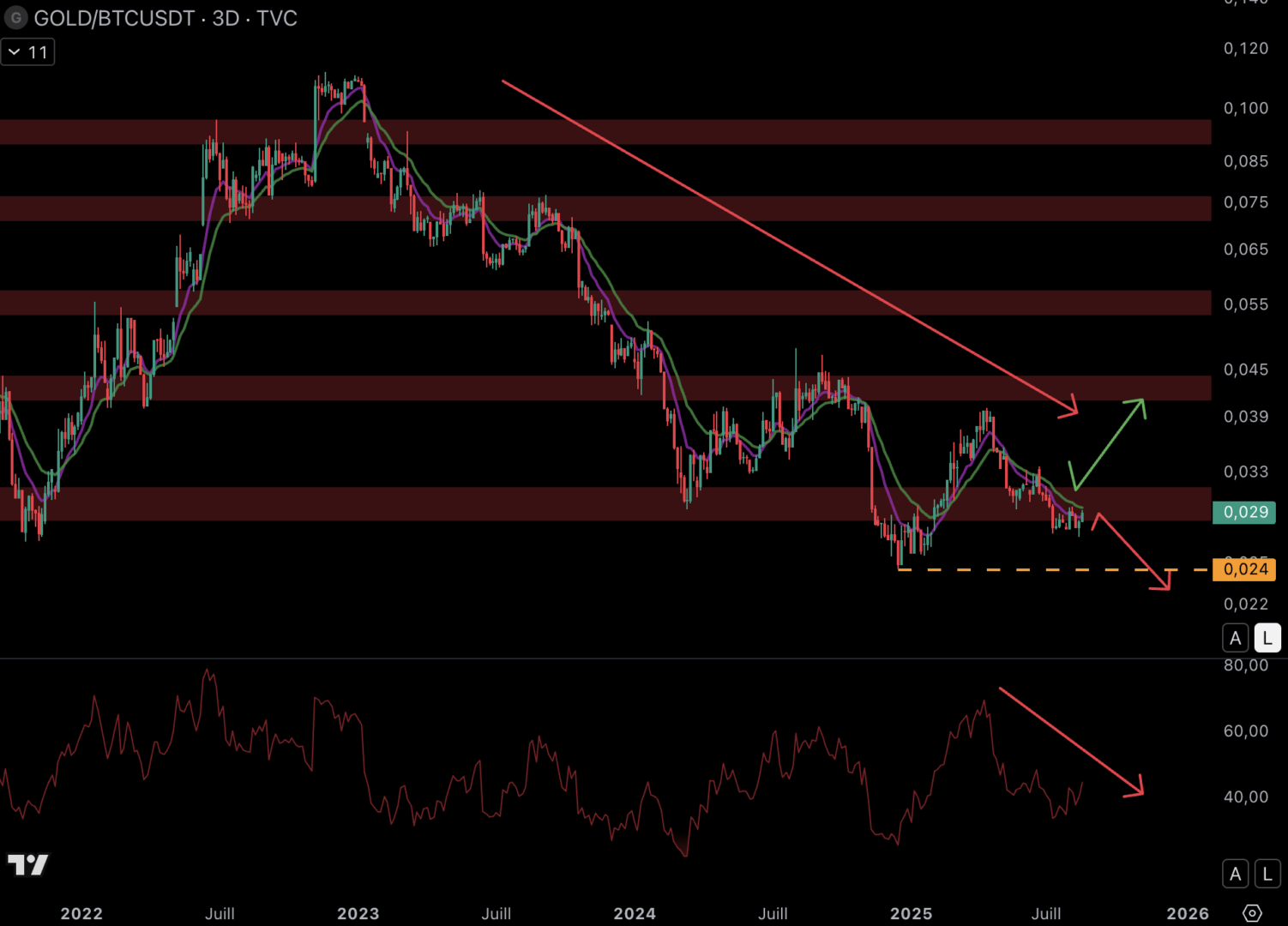

Gold is strong in front of the dollar, but that Subperform predominantly bitcoins Since the end of 2022:

So bitcoin can continue outlet goldit will take Rejection around the lower mengars and falling under Cavity at 0.024. And this scenario is quite realistic because Trend is fragile Since April on a pair of gold/BTC. The RSI FALL Also from April (fragile momentum).

The US market is always bruised from a technical point of view

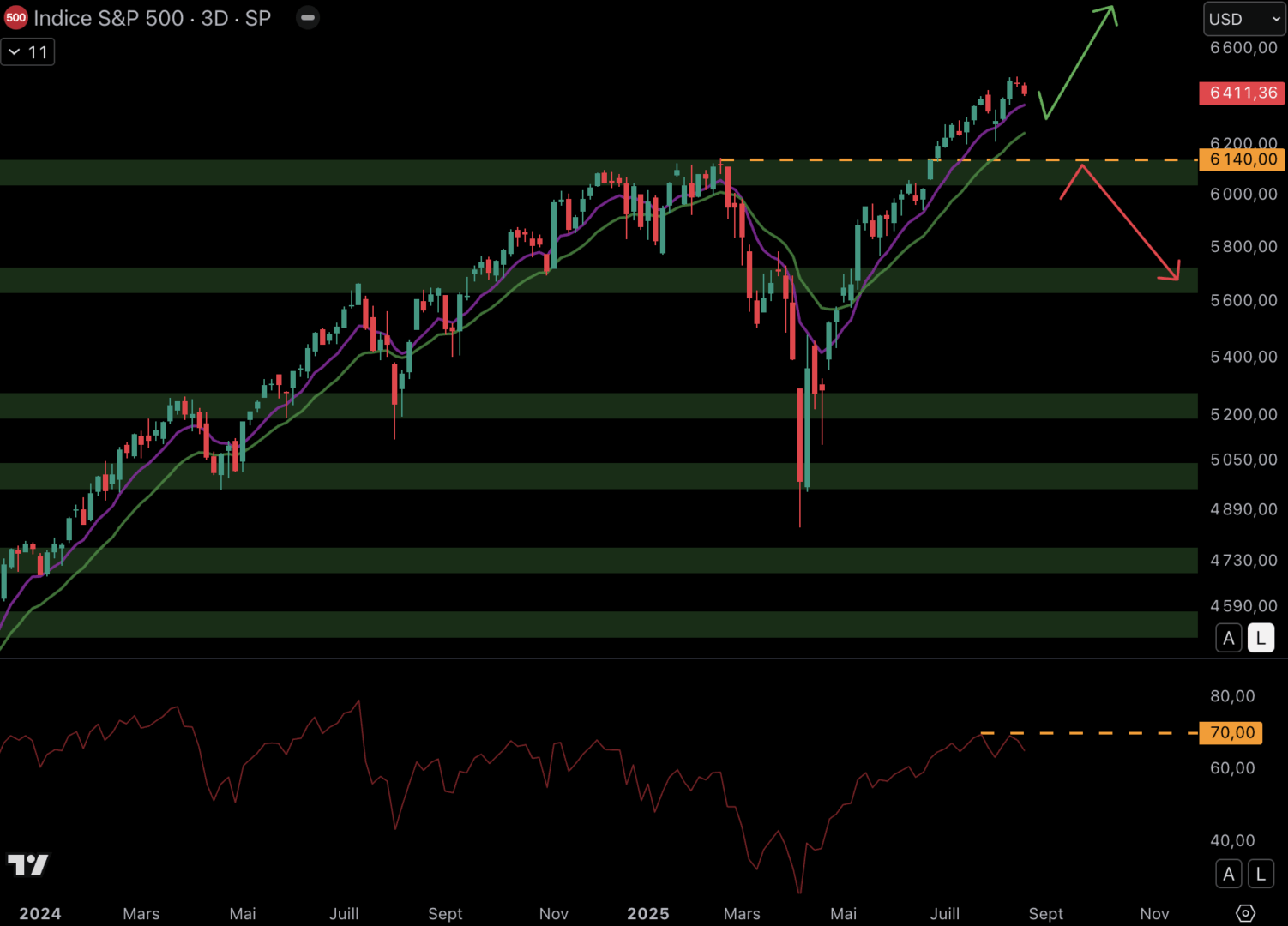

Buyers always have a hand on the S&P 500

Since April Buyers have an advantage On the pitch. S&P 500 continues to draw bull structure In 3 days, even after a slight drop recorded from August 15:

The course has already been reflected in the level Mobile Medium Hight At the beginning of August AA New reflection It could happen in the coming days. In the case of a deeper fall, the course could return to Support for $ 6,100. This level will be important because a Loss 6,100 $ could lead to a return to Support for $ 5,700.

Momentum RSI progresses since April. To stay on this dynamics it will take a fence 70.

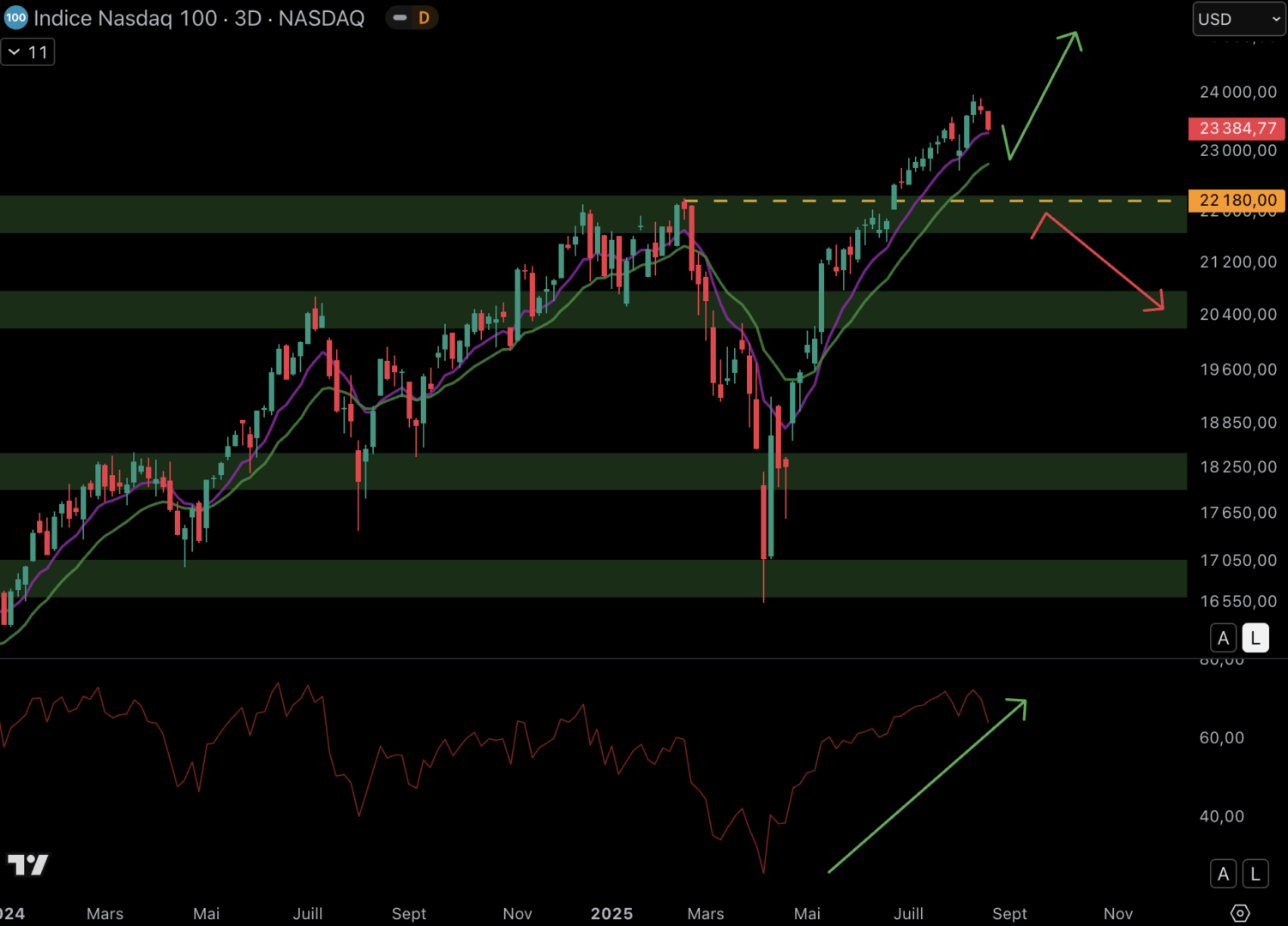

Nasdaq remains awake in spite of the recent fall

Course Nasdaq fallsbut bounce could stand around Mobile Averages (EMA 9/EMA 18) Housing ::

Other important support is around $ 22,000. If these support are held, the course could continue Assumption at $ 25,000. But if the course is weakening, it could join to Support for $ 20,500. Nasdaq is always The buyers dominated. In parallel, RSI continues to progress. The Momentum is therefore bull About this active as an asset in a time unit of 3 days.

Key elements to remember

The price of bitcoins lost $ 120,000, but the buyers are still in the unit of time 3 days. The trend is up on bitcoins, and this is also the case with S&P 500 and NASDAQ. Obviously, risky active ingredients fall for several days, but this trend remains encouraging. Gold is also in good conditions for progress in the coming months. The dollar is stabilized above 97.5, but the trend remains fragile. Risk assets are bruised from a technical point of view and, according to Bernstein, the bull may last until 2027.

(Tagstranslate) Technical Analysis