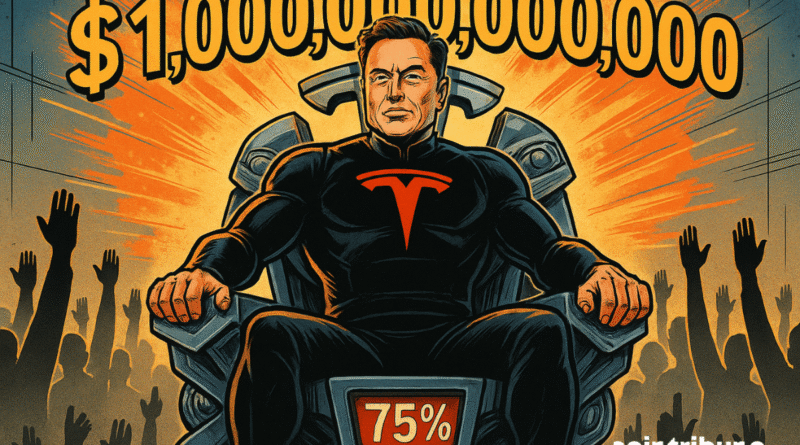

Tesla: Shareholders confirm record jackpot for Elon Musk

Summarize this article using:

From behind the scenes of his multi-faceted empire – Elon Musk remains at the helm of Tesla, SpaceX, xAI and Starlink – flowers are flying. Employees welcome a vision that they say goes beyond the automobile. But behind those awards lies a historic jackpot: a record compensation plan for Musk if Tesla reaches its goals. The stage is set, the stage is gigantic, and the stakes go far beyond electric cars.

In short

- Elon Musk could get 423.7 million Tesla shares, a potential $1 trillion.

- The plan is based on ambitious terms: sales, robotaxis, humanoid robots and stock market valuation.

- 75% of shareholders approved the offer despite criticism of management and public image.

- Musk’s vision prioritizes artificial intelligence and relegates electric cars to the strategic background.

When Tesla becomes a profit machine for Elon Musk

When it comes to this new plan, the trajectory of Musk and Tesla will turn into a profit saga. Tesla’s board has proposed giving Musk 423.7 million restricted shares, or nearly 12% of current equity, if performance milestones are met.

For Musk to get it all, Tesla’s market cap needs to climb to ~$8.5 trillion (compared to ~$1.4 trillion today). In addition, goals include 20 million vehicles sold, 1 million robotic axes in service, 1 million humanoid “Optimus” robots, and cumulative Ebitda of up to $400 billion.

Even if selling electric cars remains Tesla’s core, Musk is sending a clear signal: the future lies in AI, robotics, autonomous vehicles. Well, according to a tweet from analyst Gene Munster:

It aspires to increase production by 50% next year at an annual pace of 2.7 million cars, perhaps reaching 4 million by 2027 and 5 million by 2028. My take: They will increase production, but the supply chain will limit how quickly they can expand. $TSLA.

In this context, the XXL reward becomes less a simple bonus than a bet on a disruptive future.

Elon Musk: Shareholders agree… or fascinated?

The meeting turned out like a fanfare. At the general meeting, 75% of the votes were cast in favor of the plan. This fireworks of approval is accompanied by a standing ovation in the room. However, some high-profile investors remain suspicious of this support. Some institutional funds – such as Norway’s sovereign wealth fund – voted against.

Although Musk and Tesla enjoy broad support from retail investors, the governance dimension raises questions: Musk’s voting power could increase from ~13% to more than 25% if he meets all targets.

The company made a strategic choice: to keep what it considers a “core asset”. As analyst Dan Ives stated:

With this now-approved compensation plan keeping Tesla’s biggest asset — Musk — at the helm for years to come, we continue to believe that AI valuations are beginning to unlock. In our view, the march towards an AI-driven valuation of Tesla has now begun for the next 6-9 months, with the generalization of FSD, the penetration of autonomous technologies into Tesla’s installed base, as well as the acceleration of the Cybercab and Optimus projects in the United States.

At this crossroads, Tesla oscillates between the admiration of its fans and the wariness of its observers.

Robots, artificial intelligence… or a simple makeover in electric cars?

In this new episode from Elon Musk and Tesla, the key is clear: electric cars are just the starting point. The heart of the design lies in AI, robotics and robotaxis.

Gene Munster points out that Elon Musk’s current priority is no longer cars, or even autonomous driving or robotics. According to him, this new chapter begins with the humanoid robot Optimus — and everything else will wait.

In addition, Tesla’s internal reality casts shadows: the company’s share of the US market has fallen to its lowest level since 2017. Among cryptocurrencies, we observe a parallel atmosphere: the promise of AI and decentralization attracts capital, but fundamentals remain under pressure.

Tesla is betting big on this mix of EV, AI, robotics, borrowing from blockchain dynamics and Web3 (ethics, transparency, disruption): an interesting game of mirrors for curious crypto investors.

Key data:

- 423.7 million shares offered to Musk;

- target valuation of $8.5 trillion;

- 20 million cars are expected to be sold;

- 1 million robotic axes in operation;

- 1 million humanoid “Optimus” robots.

In this context, the question remains: is Elon Musk’s vision for Tesla a bet on the future… or simply a remake of the car business with new packaging?

Elon Musk’s imagination goes far beyond conventional logic: while Tesla is negotiating this record jackpot, Musk has just unveiled X Chat, an app he touts as more secure than WhatsApp. If all this comes true, the world of electric cars or cryptocurrencies may not have seen anything before.

Maximize your Cointribune experience with our “Read and Earn” program! Earn points for every article you read and get access to exclusive rewards. Register now and start reaping the benefits.

The blockchain and crypto revolution is in full swing! And on the day the effects are felt by the most vulnerable economy in this world, I will say against all hope that I had something to do with it

DISCLAIMER OF LIABILITY

The comments and opinions expressed in this article are solely those of the author and should not be considered investment advice. Before making any investment decision, do your own research.