5 largest global business rivals to be monitored and how their results will form the future

The strength is uncertain: the more you have, the more competitors you attract, shooting for your customers, stars and market staff. We have fired the five biggest rivalry in business, across chips, AI, EV, investment and financing and energy. And although these introduced and growing opponents are wild, never from dark horses who are hungry at the top.

See the list of the strongest people from Fortune Fortune.

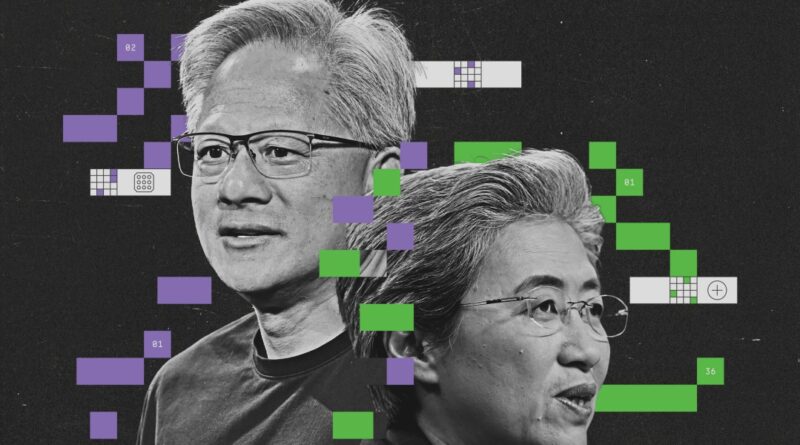

Ai chips

Jensen Huang

CEO, President and co -founder, Nvidia – USA

NVIDIA CEO Jensen Huang could be forgiven for the fact that in Momter Sovor Meteoric Rise on the peak of the stock market, the increasing census for its high -performance chips, which generative AI. Now the most valuable company in the world, Nvidia controls more than 90% of the market for specialized chips used to train and operate AI systems – this dominance in the hardware plant supports the boom. Yet Huang follows the horizon. AMD is placed as a viable alternative, while startups such as Groq, Cerebras and Sambanova bet on their own chips designed to accelerate inference AI. None is a serious threat to the dominance of NVIDIA – yet.

Lisa su

CEO and FLESH, AMD – USA

AMD Lisa SU CEO has never met her first cousin to remove, Jensen Huang until both of them raised to lead the most powerful chip in the world. “There were no family dinners,” he said in an interview for lagging. “It’s an interesting coincidence.” But they both couldn’t do each other now. Given that the company’s headquarters in the same city of Silicon Valley just moved apart, AMD is pushing hard to assert itself as a viable second source for AI chips in the middle of sharp demand. The company ensured victory from the main players such as Microsoft and Meta – both eagerly diversify their chains and reduce addiction to fixed hardware and software ecosystem NVIDIA. –Sharon Goldman

MUSK: Win McNamee – Getty Images; Wang: VCG/Getty Images

Electric vehicles

Elon Musk

CEO, co -founder and other roles, Tesla, SpaceX, XAI and OSERS – USA

Elon Musk, a man who EVS for masses, saw Tesla’s wealth eroded when he got involved in social media and politics. Tesla’s annual deliveries in 2024 fell for the first time and decreased every year every year. Musk was the future on Tesla AI and the self -governing system only for the camera, with a soft starting robotaxi in June and the development of nails of its humanoid robot. Critics claim that the technology of the company’s own management is under competitors’ technology such as Waymo and Byd. While Tesla is still the most valuable automobile company in the world, it is not clear that it will maintain the best place.

Wang Chuanfu

CEO, Fleshman and founder, Byd – China

Late Charlie Munger, one of the most successful investors of all time, described Wang Chuanf, the founder and CEO of the company, as a hardworking “brilliant” company. In 2023, when his resident began to fight with Tesla in the best place on EV, the American automotive industry began to be careful. Affordable Model Models, Ultra -fast charging technologies and free driver assistance systems helped the company acquire 20% of the global EV market. By now, Byd is also the second largest manufacturer of EV batteries in the world. –Jessica Mathews

Altman: Joel Saget – AFP/Getty Images; Zuckerberg: Chris Unger – Zuffa LLC

Artificial intelligence

Sam Altman

CEO and co -founder, Open – USA

Altman’s leadership of Openi made him one of the most powerful and polarizing figures of Silicon Valley. AI is rapidly rising to the best Tech table, with more than 780 million weekly ChatgPT users, large corporate and government customers, and plans to expand in areas from productivity software to new hardware devices that will be built by Apple Designer Jony Ive. Openai is worth almost $ 300 billion in the risk capital led by SoftBank in March, and this year it is good to generate revenues of more than $ 10 billion (at the current loss of billions of dollars a year).

Mark Zuckerberg

CEO, Fleshman and founder, meta – USA

Altman’s meteoric rise made him the patrons of enemies. Years ago he dropped out with Elon Musk and recently met Meta’s Mark Zuckerberg, who bagged OpenI Inter with multimillion compass packages. Google Deepmind competitions with OpenIi about building the most capable AI and Chatgpt models also poses an existential risk for Google’s dominance to search on the Internet. Meanwhile, no love between Altman and anthropical co -founders who bounced off in 2021 in 2021 in 2021 for concerns about Altman’s leadership and determination to safety AI. –Jeremy Kahn

Dimon: Al Drago – BloomBeg/Getty Images; Rowan: Yuki Iwamura – Bloomberg/Getty Images

Finance

Jamie Dimon

CEO and FLESHMAN, JPMORGAN Chase – USA

When he closed in his 20th anniversary as the CEO of the country’s largest bank, Jamie Dimon is an unregulated Dean of Wall Street and is ready to go down in history as one of the biggest bankers of all time. In times of crisis, markets turn into Dimon as a source of clear and uninhabited authorities. His character increased in 2024, led JPMorgan Chase to record profits of $ 58.5 billion to revenue $ 278.9 billion. Dimon also exhaled the growing competition from the world of private capital by setting up JPM’s own private credit facility – and issued a warning shot to Apolla and others to stop the poaching of junior bankers.

Marc Rowan

CEO, Flesh and Cofounder, Apollo Global Management – USA

Marc Rowan, a one -off lawyer Corporate, has appeared as a dominant character in the rapidly growing world of private capital in recent years. In 2021, Rowan became the CEO of Apollo, who was involved, and has carved a bold strategic shift in a rotating private loan, a field that has doubled over the past five years to earn $ 2 trillion. The pivot was highly lucrative and helped Apolloma record $ 1.49 billion in the 4th quarter of 2024. Rowan’s private credit fee represents a growing challenge for traditional banks such as JPMorgan Chase, as Apollo and others become borrowing places and institutions. –Jeff John Roberts

Woods: Andrey Rudakov – BloomBeg/Getty Images; Wirth: Hollie Adams – Bloomberg/Getty Images

Energy

Darren Woods

CEO and Chairman, Exxon Mobile – USA

Exxon Mobil played Exxon Mobile after skipping the US slate boom when Darren Woods took over as CEO in 2017. Woods focus on capital discipline, shareholders and M&A has the exxon back to the top of the industry where the slate output leads in a prosperous perm pelvis. His oil discoveries in the coast of Guyana are envy of the energy world.

Mike Wirth

CEO and FLESHMAN, Chevron – USA

Mike Wirth, who joined as an engineer who joined as an engineer in 1982, took over in 2018 – a year after Woods in Exxon Mobile. After Chevron served as an energy pet for several years, he now faces a revitalized exxon. Opponents in a Permian pan. They just settled a long referee rivalry over the attacked in Guyana. Even with opponents in the emerging American lithium business. Both focused on fossil fuel and related low -carbon businesses, while Europeans BP and Shell tried to grow green energy. Meanwhile, Totalenergies is the only doubling of oil to focus on renewable energy sources. –Jordan Blum

This article will appear in August/September 2025 editions Luck.

(Tagstranslate) advanced micro devices (T) Apollo Global Management (T) By